From Legacy Systems to Blockchain: Transforming Settlements in Private Markets

In today's hyperconnected world, legacy settlement processes continue to face persistent delays and inefficiencies, falling out of step with modern market demands.

Within real estate specifically, extensive paperwork is often needed, requiring involvement from an array of third parties including lawyers, brokers and conveyancers. As it currently stands, data exchanges are typically manual, requiring stakeholders to navigate fragmented and siloed processes to complete transactions.

This creates fertile ground for clearing and settlement issues.

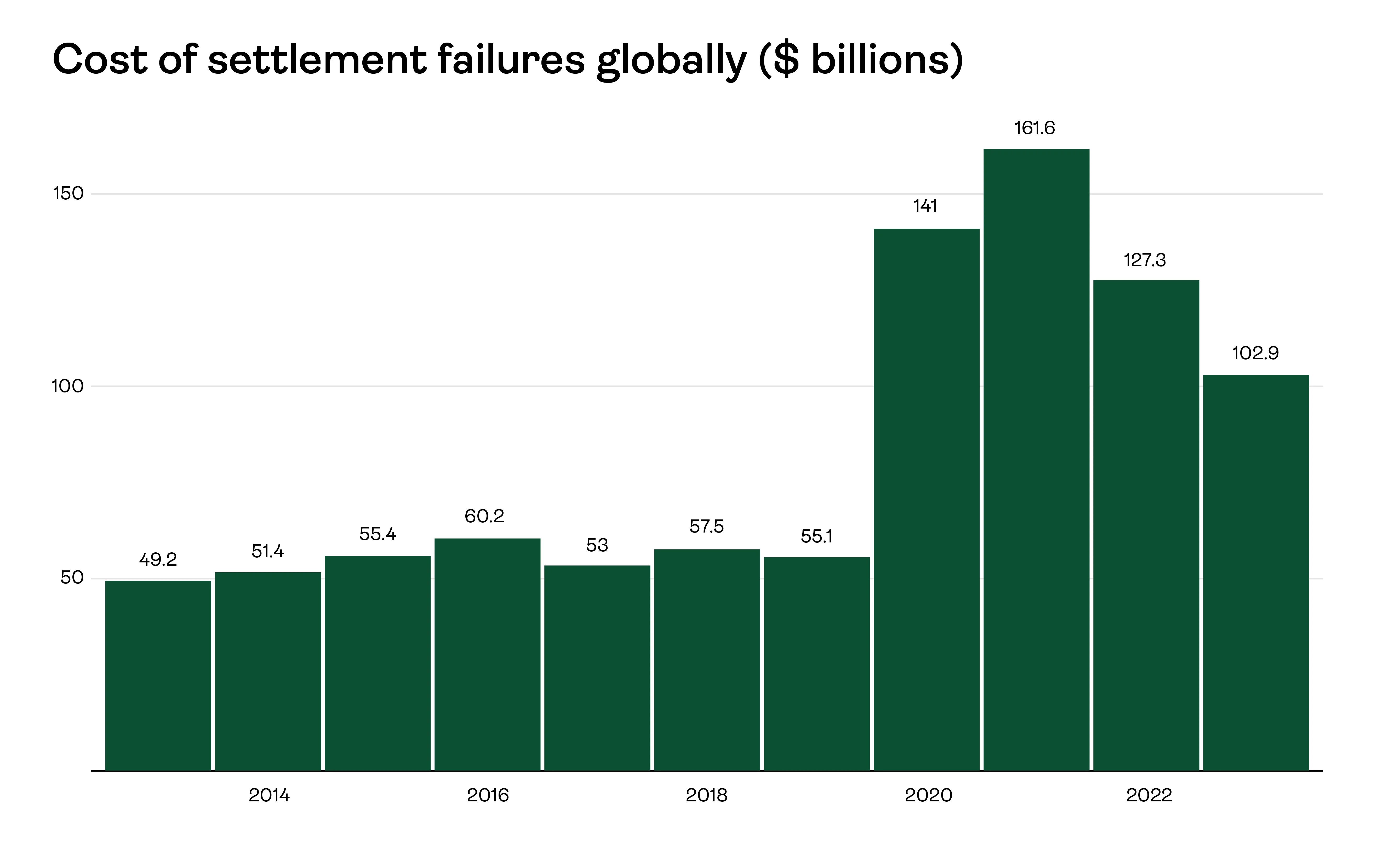

According to a 2023 industry analysis report, inefficiencies in the settlement process cost the global financial system approximately US$33 billion annually in unnecessary fees.

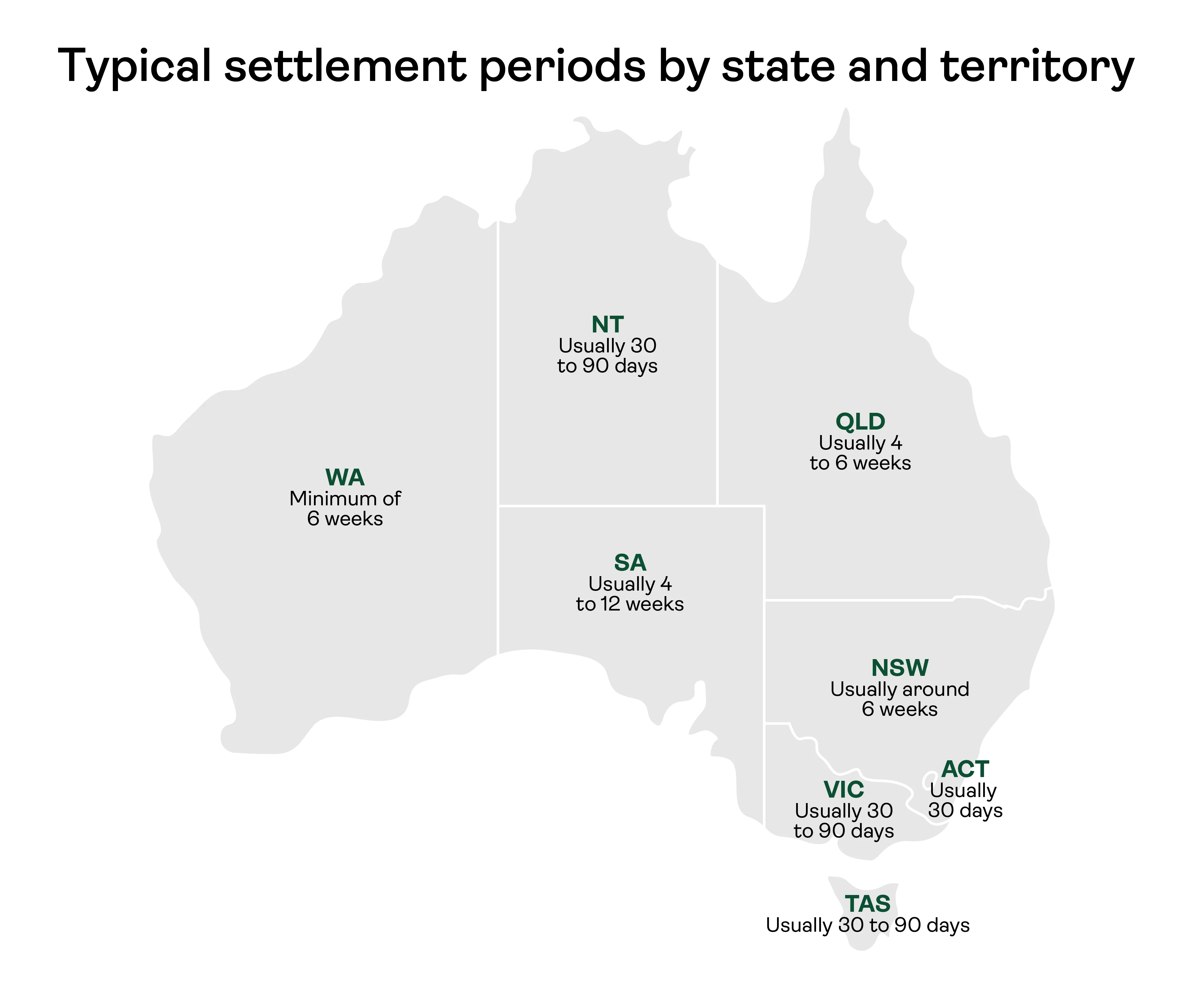

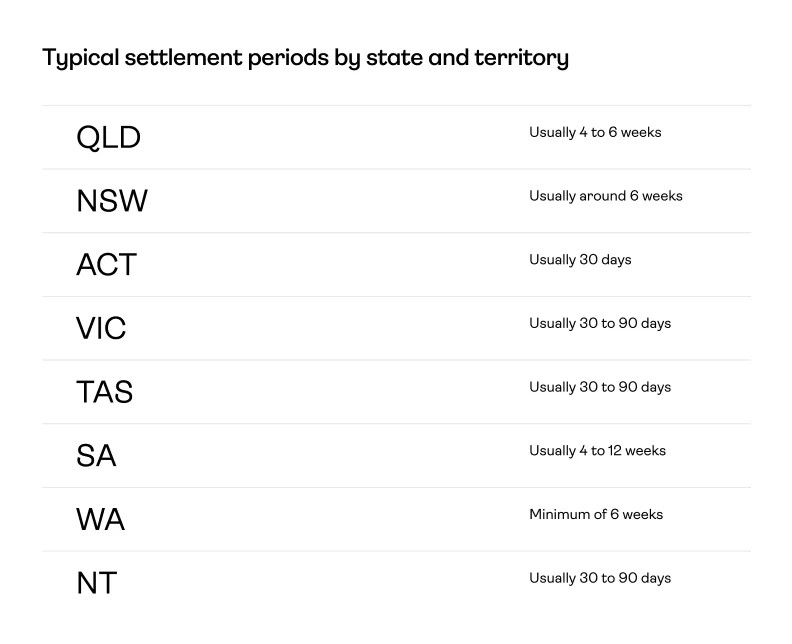

In Australia, settlement and conveyancing of property sales is a complex process involving multiple steps, legal requirements, and parties.

For example, buyers must pay stamp duty before settlement can occur and adjustments for property-related costs, such as council rates, water charges, and strata levies, must be calculated and agreed upon between both parties.

Legal professionals also need to conduct title searches and due diligence to ensure the property is free from encumbrances, caveats, or disputes that could complicate the transfer.

Throughout this process, buyers and sellers need to liaise with each other and their advisers (lawyers, conveyancers and brokers), along with banks and government bodies like the Land Titles Office.

Optimising the Settlement Layer with Technology

While technological advancements including digital signatures and online document management systems have made it easier to share information, there is still significant room for improvement.

This is where Distributed Ledger Technology (DLT) comes in.

DLT is a rapidly emerging technology that has the promise of revolutionising settlement and conveyancing processes in property transactions, and beyond.

Not only can DLT address inefficiencies within the existing system, but it can unlock significant amounts of trapped, unproductive capital currently tied up as collateral and margin requirements.

By enabling near-instantaneous settlements and providing real-time transparency, DLT reduces the need for over-collateralisation, freeing up resources for more productive use while enhancing liquidity and operational efficiency across the property and financial markets.

Improved transparency

Perhaps the most obvious benefit which DLT provides to private market settlements is increased visibility.

Poor access and visibility of data is a significant impediment to seamless trade settlements as data is often siloed across various parties, making it difficult to obtain a single, unified view of critical transaction and counterparty information.

DLT provides an immutable source of truth where all parties—buyers, sellers, legal advisers, banks, and government bodies—can access verified information and real-time updates, reducing delays caused by siloed information.

Near-instantaneous settlement

In public markets, the prevailing ‘Delivery versus Payment’ (DvP) settlement system is a cornerstone of financial markets that enables the smooth, albeit slow, settlement of transactions, typically within two-to-three days.

In private markets, due to a lack of centralised clearinghouses and standardised processes, the settlement process can take significantly longer. In Australia, the average settlement time for a property sale takes anywhere between 1-3 months.

As mentioned previously, this can be largely attributable to legacy processes - something which DLT can greatly enhance. By creating a shared, immutable ledger, DLT enables all parties involved in a transaction to access a single source of truth in real time.

This eliminates the need for redundant checks and reconciliations, significantly speeding up the settlement process. Additionally, smart contracts can automate key steps, such as triggering payments, verifying ownership transfers, and updating registries once predefined conditions are met.

Automation

Beyond the purchasing and selling of an asset, efficiency gains through automation can be extended to other aspects. For example, DLT can be adapted to coordinate and automate actions such as dividend and coupon payments, voting, share/unit buybacks, rights issues, and more.

Additionally, embedded smart contracts can reduce the ability for counterparties to renege on contractual obligations by ensuring the required prerequisites on both sides are met before a transaction is automatically executed.

In principle, these advancements have the potential to transform the lifecycle of securities in both private and public markets, enhancing transparency, reducing operational risks, and driving significant cost savings.

How Ownable is Accelerating Settlements in the Real Estate Sector

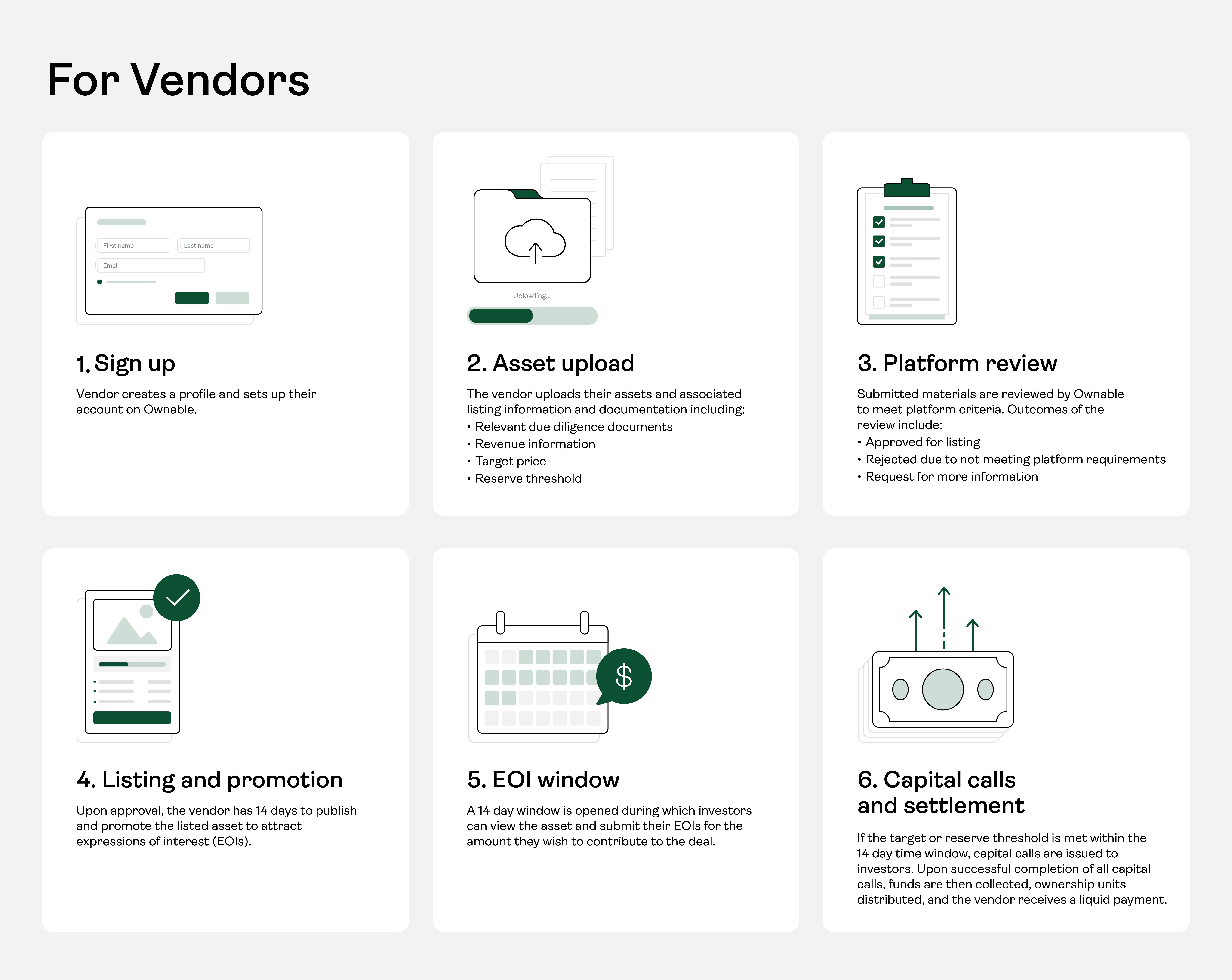

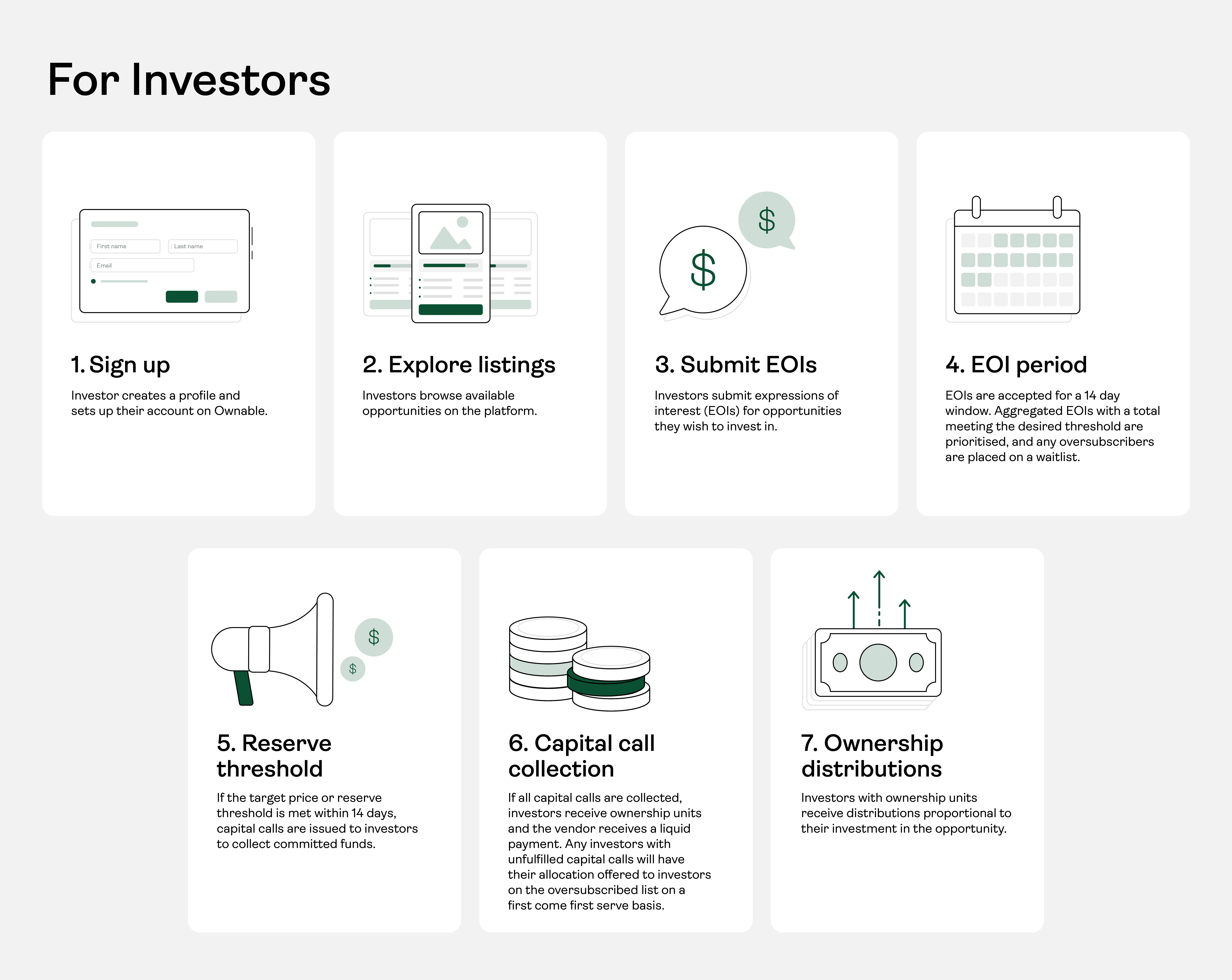

Ownable uses technology, including DLT, to streamline workflows across the entire investment process. From listing and allocation to sales, our platform simplifies cash flow generation, portfolio management, and tax reporting, ensuring ease and security.

All documentation and regulatory requirements are handled by the Ownable platform significantly reducing time spent on verification and approval. This not only accelerates settlement timelines but also enhances the overall user experience.

Here’s how it works:

By providing real-time visibility into transaction statuses, Ownable empowers investors and vendors to make faster, more informed decisions. This level of transparency fosters trust among all parties and further expedites settlements.

Seamlessly integrating with existing systems, Ownable opens bottlenecks caused by outdated technology and poor interoperability, ensuring a more efficient and connected investment ecosystem.

Ownable offers a smarter way to buy and sell real and alternative assets. Simplify settlements, reduce delays, and unlock more efficient transactions today.