Real Estate Outlook: Where Next for REIT Valuations?

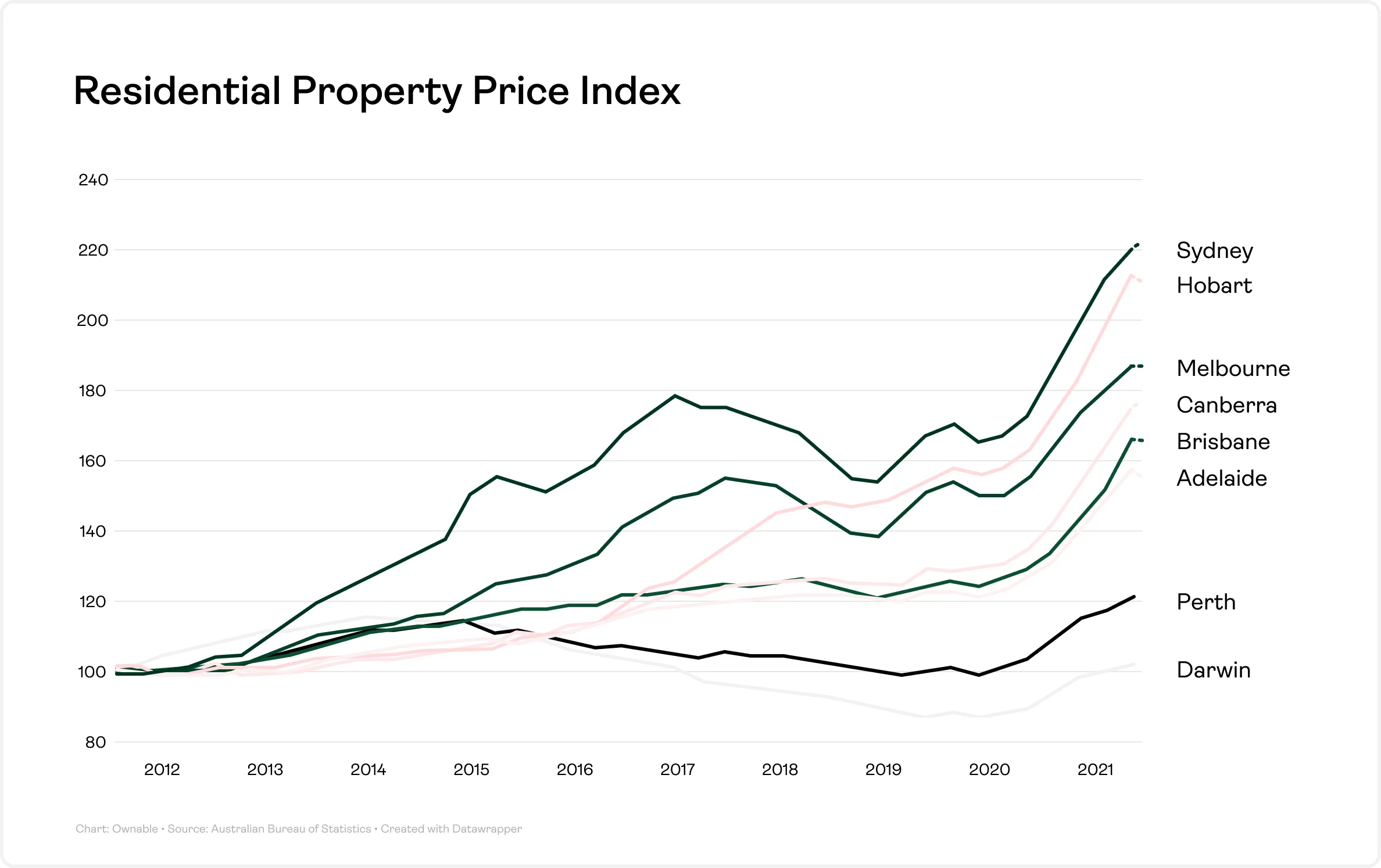

Since the onset of COVID-19, real estate in Australia has experienced significant value appreciation. This has been driven by a combination of factors including low interest rates and government stimulus.

For residential property specifically, the COVID-19 pandemic has fundamentally reshaped how Australians view their homes, with many prioritising space, lifestyle, and flexibility as remote work and lifestyle have become increasingly desirable.

This shift has sparked heightened demand across both urban and regional markets, intensifying competition and driving property values to record highs. Compounding this trend is a limited housing supply in key markets, further fueling price growth and creating a highly competitive environment.

While this upward trajectory underscores the resilience of Australia’s residential property market, it has also amplified concerns around affordability and accessibility, raising questions about long-term sustainability and housing equity.

Source: Australian Bureau of Statistics

Inflection Point

While residential property values have largely appreciated across all major cities since the COVID-19 pandemic, certain segments of commercial real estate have experienced weaker demand.

For example, office buildings have continued to face significant challenges due to the sustained shift toward remote work. Similarly, certain retail assets such as shopping centres have faced significant challenges, also as a result of the COVID-19 period.

Both segments however are now showing strong signs of potential recovery with offices and retail assets positioned well for 2025 due to demand outpacing available supply.

REIT Recovery

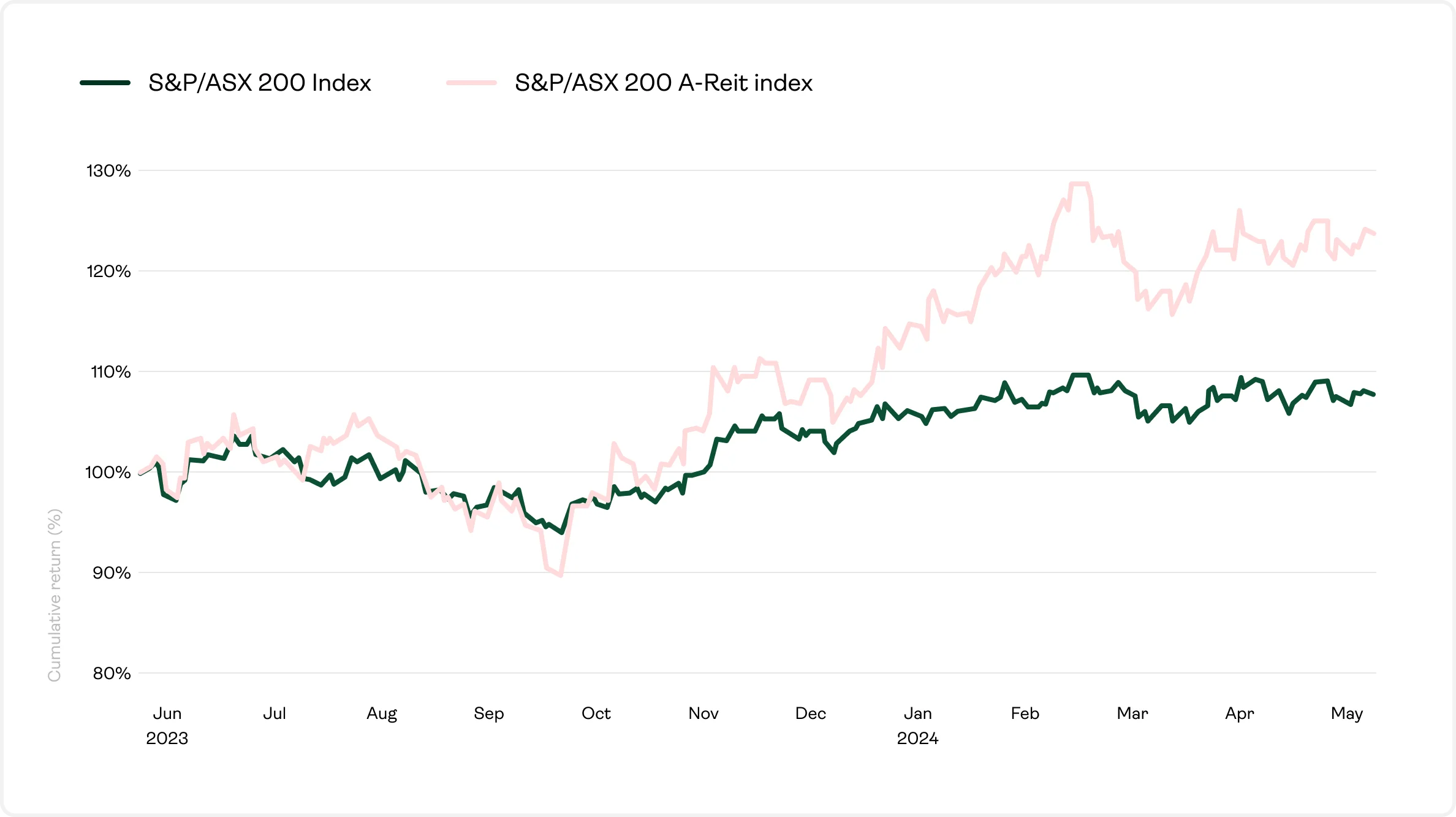

Unsurprisingly, A-REITs have seen a strong recovery from the pandemic lows and are continuing to outperform the ASX 200.

Source: BDO A-REIT Survey 2024, pg 13

The S&P/ASX A-REIT 200 Index returned 19.9% in FY24, outperforming the equity market Index (ASX 200 Index) by 12.1%. However, while these results highlight the case for investing in REITs, many of the underlying structural challenges within the sector persist.

Market Volatility

Publicly traded REITs are often influenced by stock market fluctuations, meaning their value can rise or fall with broader market sentiment, even if the underlying properties perform well. This volatility can be driven by factors unrelated to the real estate assets themselves, such as geopolitical events, economic data releases, or shifts in investor confidence.

For instance, during a market downturn, investors may sell off REIT shares along with other stocks, even if the REIT’s portfolio of properties remains stable and continues to generate income. This disconnect between asset performance and share prices can make REIT investments less predictable in the short term, particularly for investors seeking stability.

In FY24, the premium/discount to Net Tangible Assets (NTA) for A-REITs in FY24 was -17.8%, implying current unit price valuations are not reflective of the underlying assets. Additionally, there were just nine A-REITs that traded at a premium to NTA within the same time period.

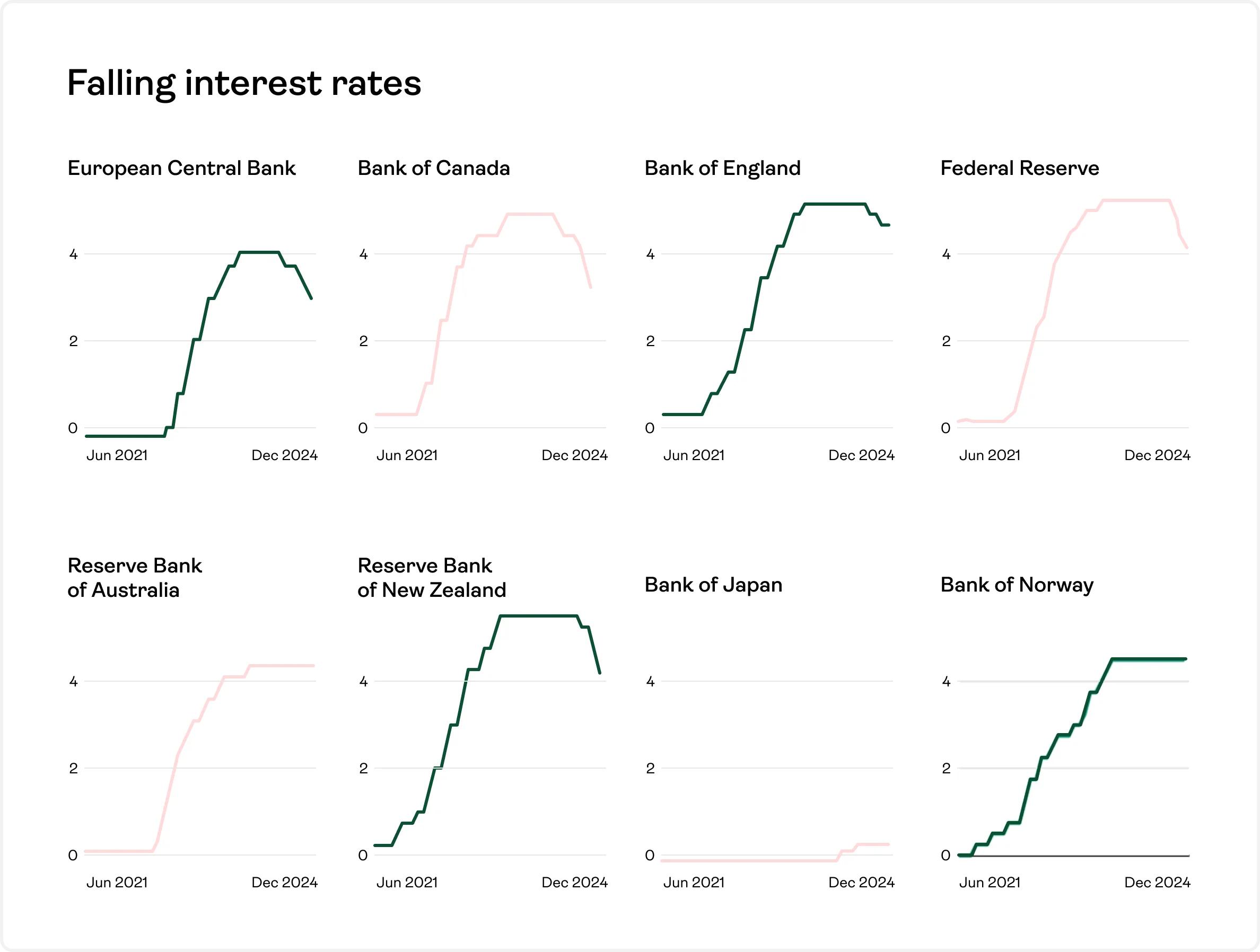

Interest Rate Sensitivity

A key investment consideration with REITs is that they are highly sensitive to interest rate changes. This is due to their reliance on debt to finance property acquisitions and the development of projects.

When interest rates rise, borrowing becomes more expensive, directly impacting a REIT’s profitability. Higher interest costs reduce cash available for investor distributions, potentially lowering dividend yields and diminishing their appeal as income investments.

This sensitivity to interest rates highlights the importance for REIT investors to monitor monetary policy and understand how changes in the interest rate environment can influence both the short-term performance and long-term growth prospects of their investments.

By contrast, direct investment in individual assets can offer greater insulation from market changes, as these investments are not subject to the same broad market pressures that can affect pooled vehicles like REITs.

Future Outlook

In Australia, supply constraints across housing and commercial assets, higher construction costs, and a growing population will likely continue to put upward pressure on real estate prices in key markets.

Moreover, a lowering of interest rates could further fuel this upward trend in property prices, given lower borrowing costs typically make mortgages and development financing more affordable, incentivising both buyers and investors to enter the market.

For REITs specifically however, funding is typically influenced by longer-term interest rates, and these have been somewhat rising in Australia, the U.S., and elsewhere. This trend suggests REITs may face higher borrowing costs despite broader rate cuts, potentially impacting their profitability and appeal.

Source: Trading Economics

Invest with Ownable

Discover a smarter way to build your portfolio with Ownable. Our platform empowers investors to gain fractional investment exposure to a range of opportunities including direct retail and commercial real estate assets.

Whether you’re looking to diversify your portfolio, explore new opportunities in private markets, or take control of your investment strategy, Ownable simplifies the process while offering unmatched flexibility and insights, providing access to a diverse range of investment opportunities.