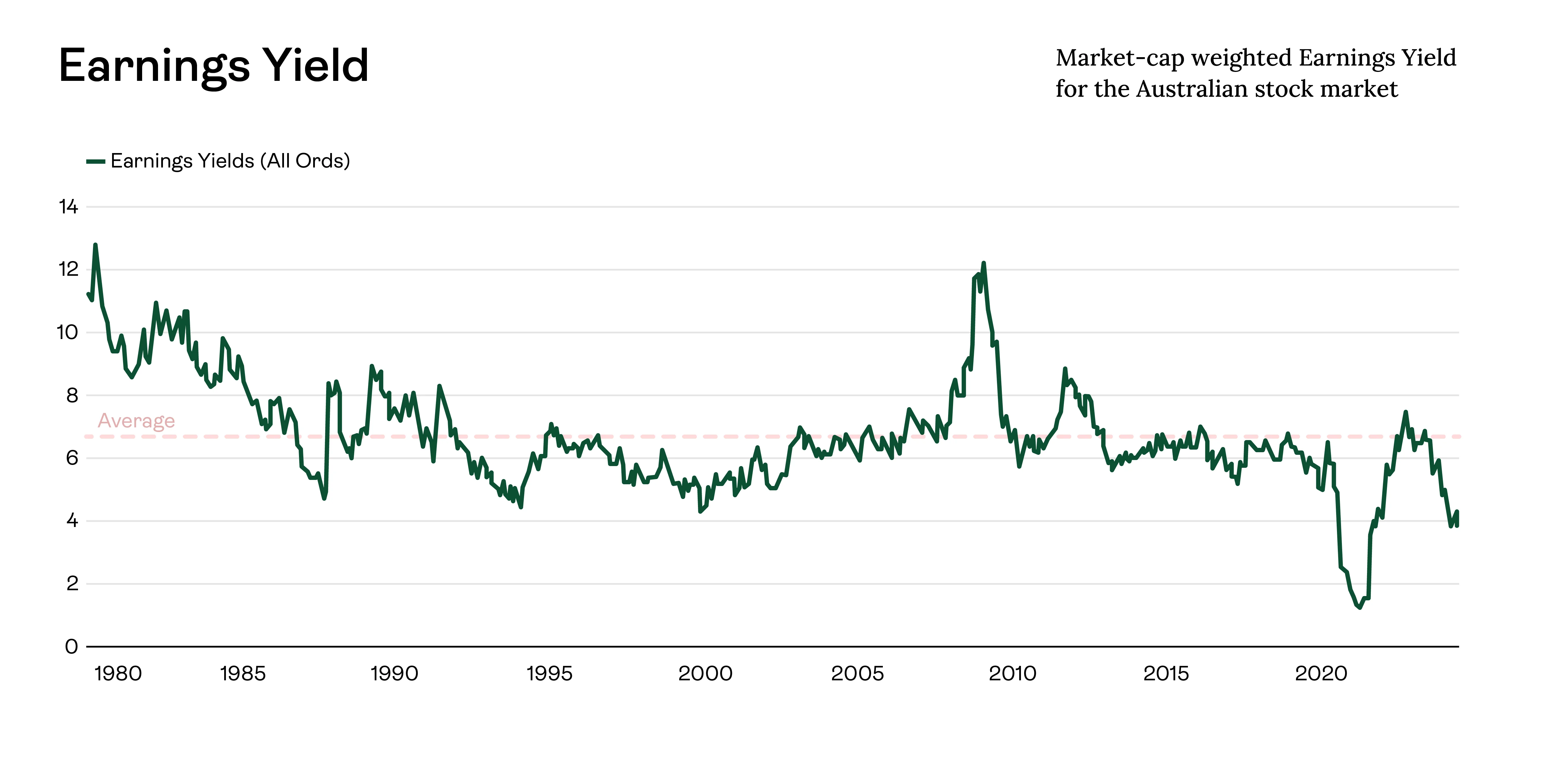

Dwindling Dividends - How Private Markets Can Fill the Void

With its strong dividend-paying culture underpinned by the likes of major banks, mining giants, and other blue-chip companies, Australia has long been a haven for income-seeking investors.

For decades, Australian shareholders have enjoyed consistent income streams, bolstered further by the unique benefit of franking credits.

However, the landscape is actively shifting and the dividend yield of the S&P/ASX 200 is likely to be its lowest in 2025 when compared to typical dividend paying years.

This requires income-seeking investors to look further afield and beyond traditional equity markets.

Source: Market Index

The Decline in Dividend Yields

As economic uncertainty persists and corporate priorities evolve, many traditional dividend stocks are under pressure, leaving investors searching for alternative income sources.

Several factors are contributing to this decline in dividend payouts including:

- Higher interest rates: As borrowing costs increase, businesses face higher debt servicing expenses, reducing their capacity to maintain high dividend payouts.

- Pandemic recovery: Many companies are still shoring up their balance sheets after disruptions from the COVID-19 pandemic, prioritising reinvestment over payouts.

- Regulatory pressures: Particularly in the banking sector, regulatory requirements to maintain higher capital buffers are constraining traditional high-dividend players.

In addition to the above, some Australian companies have chosen to undertake share buybacks, rather than distribute surplus cash directly back to shareholders as dividends.

Qantas for example, recently announced a $400 million share buy back, but didn’t declare a dividend, for a fifth year in a row. This buy back followed an earlier A$869 million of buy-backs in 2024.

While mining companies and the ‘big four’ banks delivered healthy dividends in 2024, the declining overall dividend yield of the ASX reflects broader shifts in the market.

For income-focused investors—retirees, in particular—declining dividends pose a significant challenge.

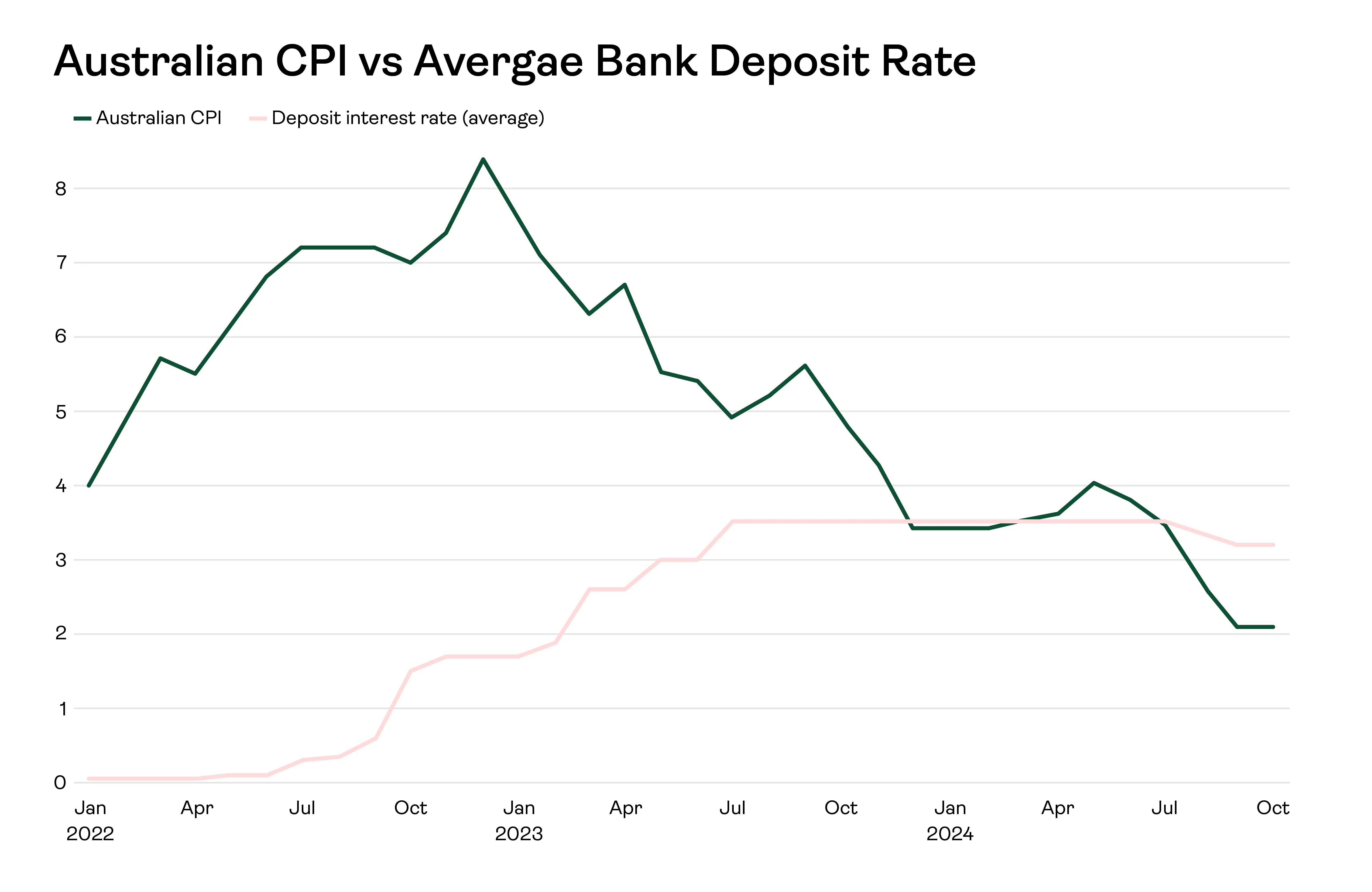

Additionally, with elevated inflation eroding purchasing power, and low-risk fixed-income options delivering insufficient yields, some investors will feel compelled to seek out sustainable income through alternative avenues.

Source: Trading Economics, ABS

The Role of Private Markets

Private markets are emerging as a compelling solution for those seeking steady income.

These investments, which include private equity, real estate, infrastructure, and private credit, offer several advantages in the current environment:

- Higher Yields: Private market investments can provide higher income yields compared to public market dividends. For instance, infrastructure assets like toll roads or renewable energy projects generate predictable, inflation-linked cash flows, which can be distributed to investors.

- Diversification: Private markets allow investors to diversify their income sources beyond traditional equities and bonds. Exposure to sectors like private real estate or direct lending reduces reliance on public market performance.

- Stable Cash Flows: Unlike public equities, whose dividends can be subject to market conditions, private assets often have long-term contracts or agreements in place that ensure stable and predictable returns.

- Access to Growth Opportunities: Private equity funds often invest in growing companies, combining the potential for capital appreciation with regular income through dividends or profit-sharing.

Unlocking Access - With Fractional Investing

A key challenge of private markets is the traditionally high barrier to entry, which has limited participation to institutional investors and high-net-worth individuals.

For example, private market investments often require significant capital commitments, lengthy lock-up periods, and sophisticated due diligence, creating obstacles for everyday investors.

Fractional investing platforms like Ownable are making private markets more accessible to qualified investors by allowing individuals to buy fractional exposure to private real estate, infrastructure projects, or private equity funds.

These platforms are enabling broader participation, for investors seeking income in a world of dwindling dividends, this represents a significant opportunity to create diversified, resilient portfolios.

Ready to take the next step? Start investing in private assets with Ownable today.