Fractional Investing: A New Era of Investment Management

Financial markets play a pivotal role in society by enabling trade, supporting innovation, and creating pathways for wealth generation.

Rudimentary derivative contracts in ancient civilizations allowed for the transaction of goods without immediate exchange, while the establishment of bourses in the 17th century provided companies like the Dutch East India Company with the ability to raise capital to fund their endeavours.

While financial markets are infinitely more advanced today, they continue to evolve and adapt to the changing requirements and demands of society.

Drivers of Change

From the advent of electronic trading to the rise of passive index funds and blockchain technology, various waves of technological innovation have been reshaping financial markets in recent times.

Each of these innovations has introduced a transformative wave of new capital efficiencies, helping to streamline operations, reduce costs, and enhance the speed and accuracy of transactions. This is enabling businesses to allocate resources more effectively and capitalise on emerging opportunities. For investors, it is unlocking access by driving down costs.

The rise of electronic trading, for instance, fundamentally changed the speed and efficiency of transactions, enabling a much faster turnover of assets and reducing the reliance on traditional floor trading. It also enabled retail investors to better participate alongside institutional participants.

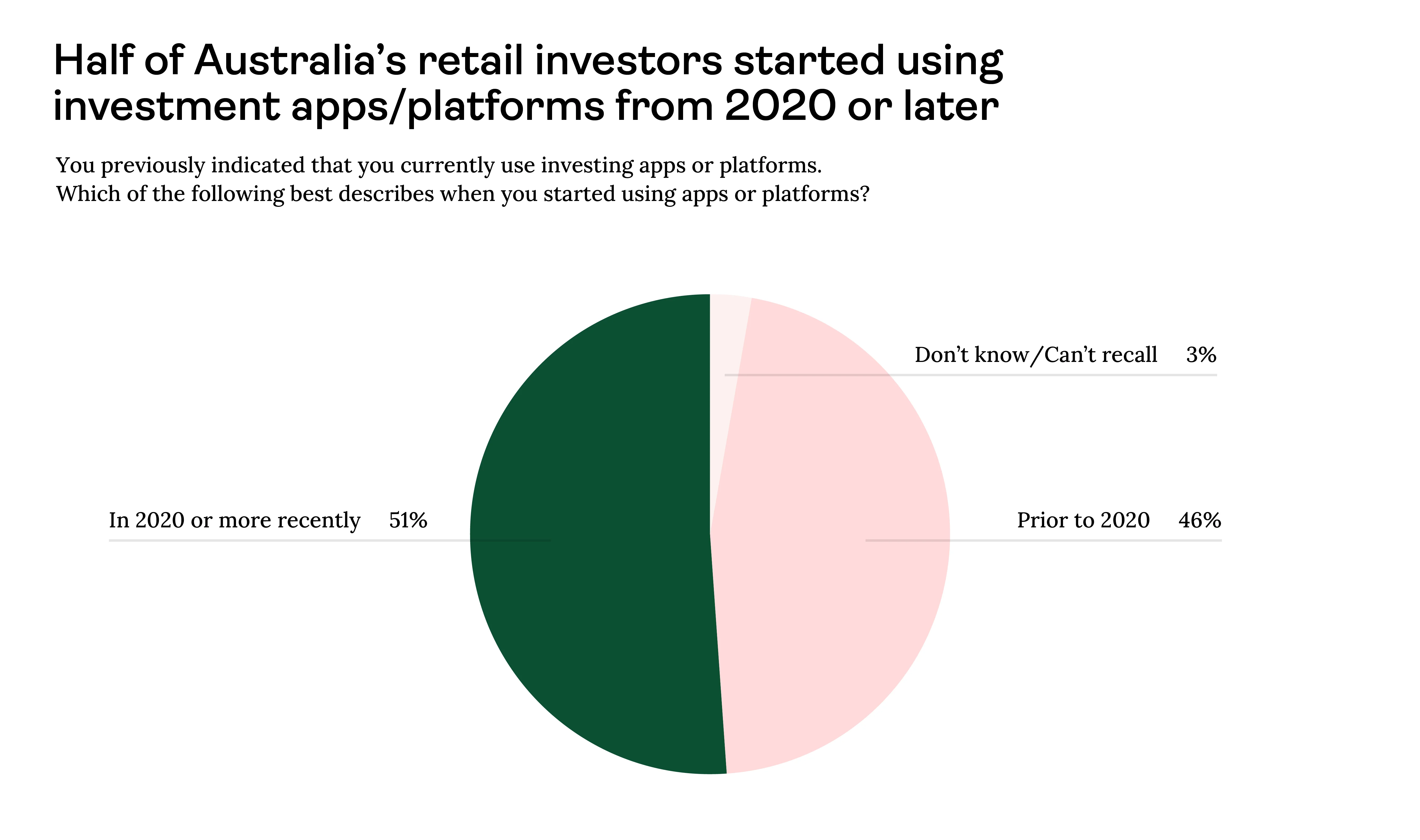

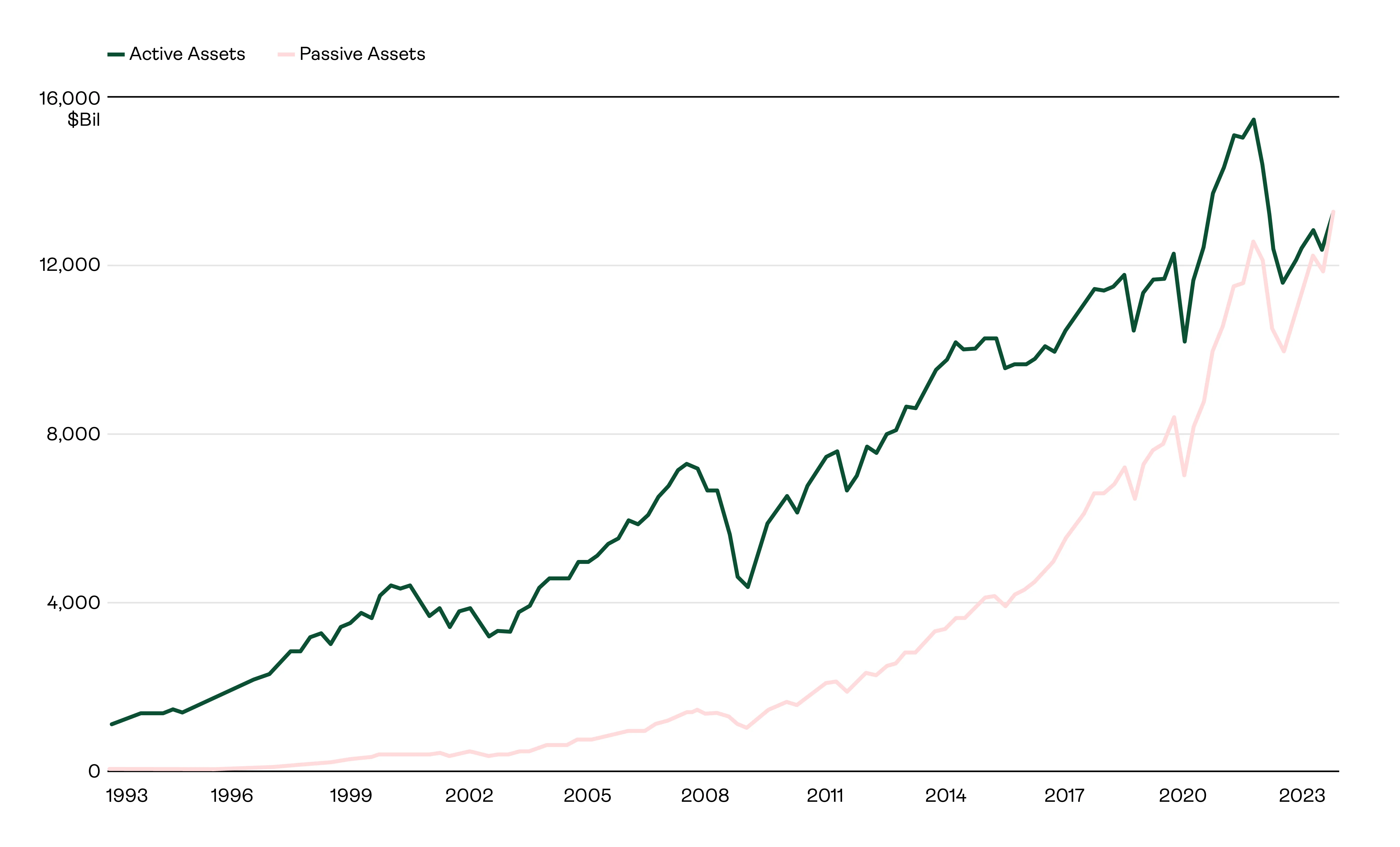

Similarly, passive index funds introduced a new low-cost approach to investing, providing a simple and diversified way to gain exposure to a broad range of assets within an index.

Like electronic trading, passive investing has seen widespread adoption, especially from individual investors, enabling them to build robust portfolios without requiring in-depth market expertise or frequent trading.

In fact, the uptake of passive index funds has grown so exponentially that it has fundamentally reshaped the investment landscape, sparking concerns about potential market distortions from concentrated capital flows.

Regardless, it is clear that passive investing has revolutionized financial markets by offering a capital-efficient approach to asset allocation. By reducing costs, simplifying portfolio management, and enabling broad market exposure, it has democratised market access for both individuals and institutions alike.

Fractional Investing Revolution

Perhaps one of the most significant drivers of change in the last decade has been that of distributed-ledger technology (DLT), emerging as a potential cornerstone for future financial infrastructure.

DLT, or blockchain technology, is fundamentally changing how people access financial markets, bringing a wave of democratisation, transparency, and cost savings.

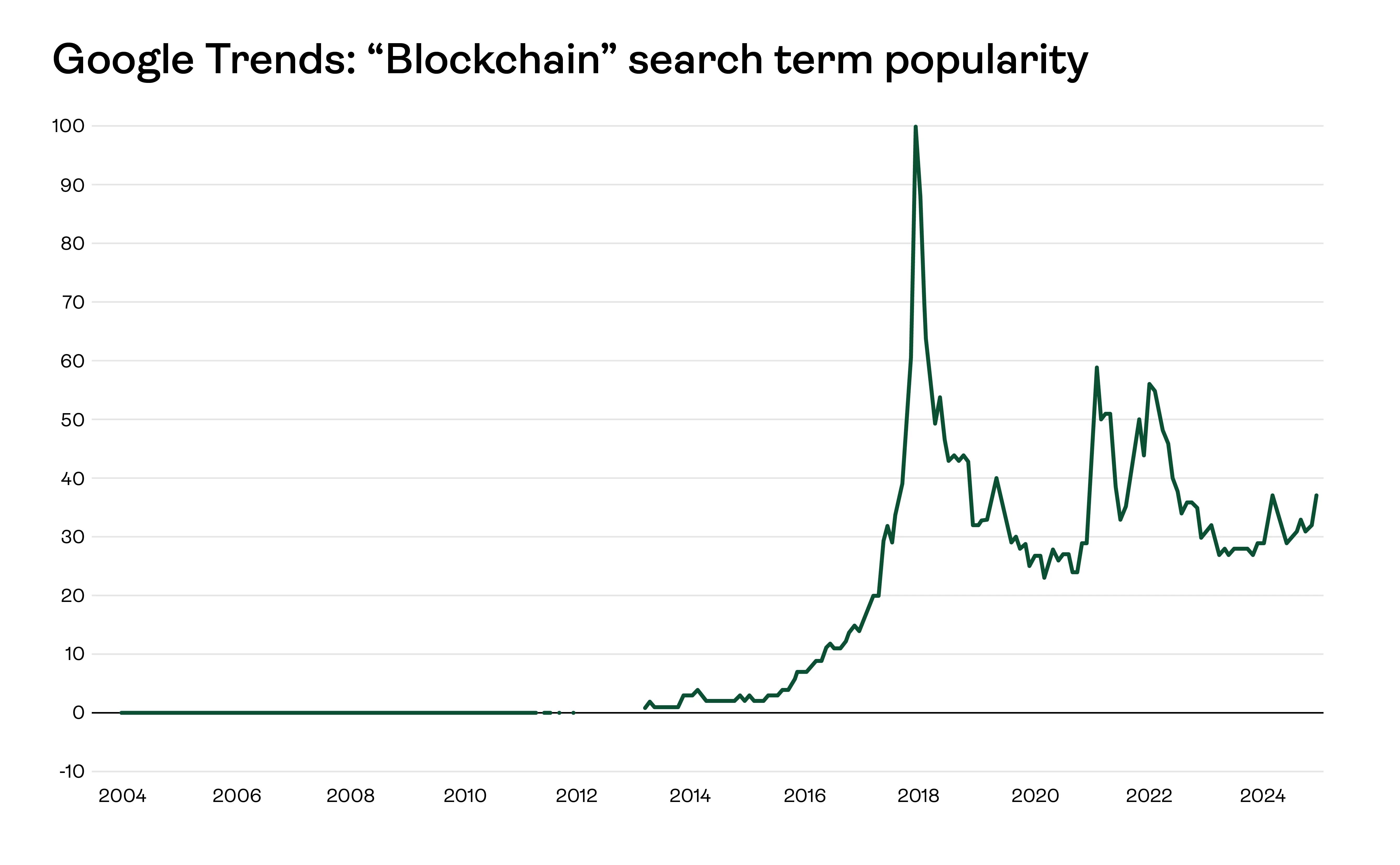

Source: Google trends

By leveraging a decentralised and transparent ledger system, blockchain is making financial services more accessible, especially for individuals and regions traditionally excluded from these systems.

One of blockchain's most notable benefits is its ability to provide broader access to investment opportunities, particularly those within private markets. By enabling the fractionaliation of assets, investors are better able to participate in opportunities which have been traditionally reserved for ultra wealthy and institutional investors.

For example, consider the commercial real estate market, which has long been dominated by institutional investors due to the substantial funds typically required for direct property ownership.

By fractionalising commercial assets into ownership units, investors can now own a portion of a prime real estate asset with a minimal investment, gaining exposure to potential rental income and property value appreciation without needing to make a large upfront capital commitment.

While real estate investment trusts (REITs) do exist, expensive management fees, unit price fluctuations, and the potential for valuations to become stretched, relative to the assets within the fund, can all act as a deterrent.

Investing Directly into Private Markets With Ownable

As private markets continue to gain prominence, fractional investing platforms like Ownable are well-positioned to provide access to high-value illiquid assets.

Unlike traditional funds, where investors pool capital and rely on fund managers to make investment decisions, direct investment through fractional platforms allows investors to own a specific, tangible portion of an asset.

By providing a streamlined, user-friendly platform, Ownable opens up the world of private market investing to qualified individuals, who may not have had the financial resources or connections to access these exclusive assets in the past.

The platform’s simplified, digital-first approach makes it easy for investors to explore, select, and manage investments that align with their goals, all while gaining exposure to high-value assets that can enhance portfolio diversity.

Ready to take the next step? Start investing in private assets with Ownable today.